Taking care of yourself doesn’t just apply to your physical health or emotional well-being, it also refers to practising better financial self-care. When you neglect your finances, it can wreak havoc on your life and will inevitably affect your relationships, career, home, and health.

By focusing your financial self-care, you can transform your life and safeguard your future. To start incorporating financial self-care into your day-to-day life, take a look at these top tips now…

Know your income

Whether you work part-time, you’re self-employed or you have a full-time role, you probably don’t know exactly what you earn. Even when you know your annual salary or hourly rate, chances are you don’t know how much you actually get when tax and other deductibles are subtracted.

If you don’t know exactly how much money you have coming in, there’s no way you can manage your budget. By identifying your regular income, you can make clear cut decisions about how much to spend, save or splurge.

Deal with debt head-on

Most people have some level of debt, whether it’s a residential mortgage, student loans or spiralling credit card bills. Although dealing with debt can seem overwhelming, it’s best to tackle it head-on. Often, people end up paying more interest than they need to simply because they don’t take a proactive approach to debt management. With independent advice and support available, you can access expert help if you’re struggling to manage your financial obligations alone.

Identify your assets

If you own a car, smartphone, laptop or jewellery, then you have assets and you might be surprised how much value they hold. In fact, the contents of an average make-up bag are well over $150, so you could be worth more than you realise!

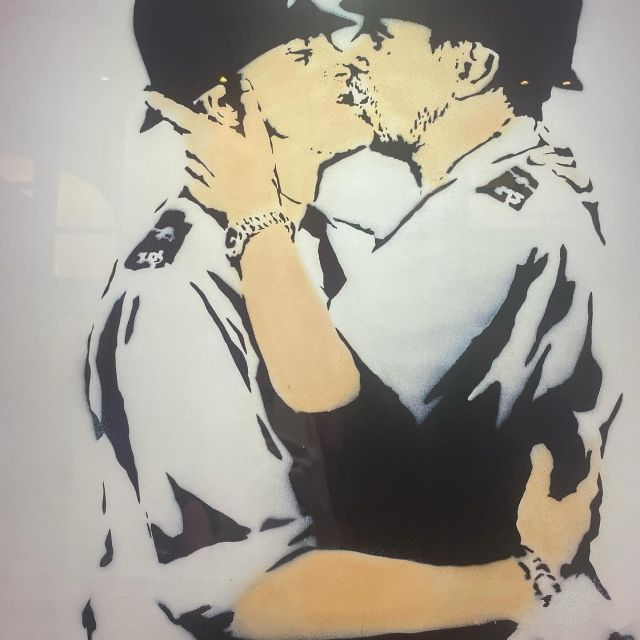

For more notable assets, you may want to get an independent assessment to ensure you know its value. It’s important to access professional advice when evaluating artworks , expensive jewellery or rare antiques, for example. As well as helping to establish the value of your estate, this information will help you to ensure you have the right level of insurance in place.

Set yourself goals

If you don’t have a clear objective in mind, it’s easy to let money slip through your fingers. When you’re saving to buy a house or take a dream holiday, however, you’ll find it easier to stay motivated and keep on top of your finances . Remember – a financial goal doesn’t have to include a big purchase. Treating yourself to something small will give you the incentive you need to manage your budget and ensure you can treat yourself to something nice on a regular basis.

Enjoy Managing Your Finances

If creating a budget and reducing your outgoings sounds like a drag, it’s time to take a different approach. Some people find that money tracking and budgeting apps can help, such as Pocket Book. By turning your new financial plan into a challenge, you can begin to enjoy the process of becoming more financially aware. Once you start to reap the benefits and have more disposable income at the end of every month, you’ll be glad you incorporated financial self-care into your day-to-day routine.